Research shows first time buyers are getting older

15 October 2018

Research carried out by housebuilder Larkfleet Homes and First Time Buyer magazine has revealed that the current generation of first-time buyers is older than the one that preceded it.

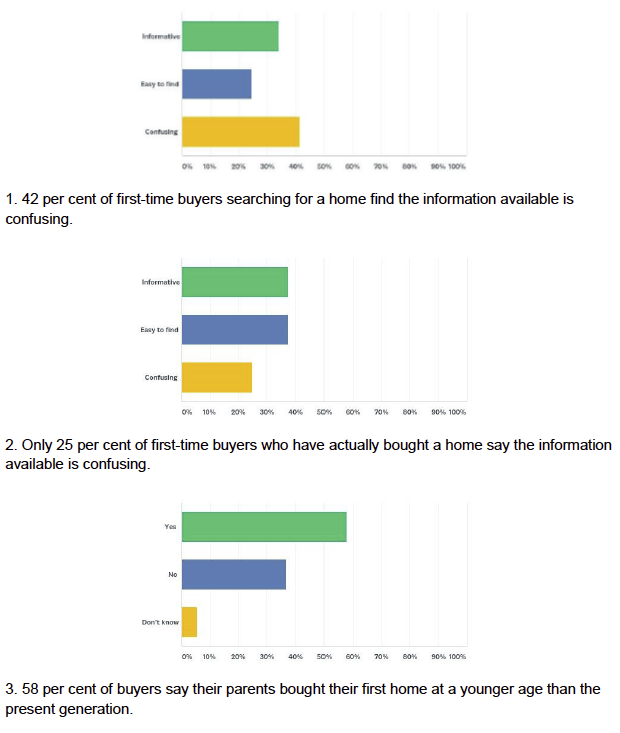

In an online and telephone survey of house-buyers, Larkfleet found that 58 per cent said that their parents bought their first home at a younger age than the respondents themselves had done.

On average, first-time buyers now are three years older than they were just ten years ago.

Larkfleet CEO Karl Hick said: “This is a reflection on the changing market for home ownership. The age of first-time buyers is rising because house prices are rising faster than real wages. It is becoming more and more difficult for people to get onto the so-called ‘housing ladder’.”

The research also showed that 42 per cent of first-time buyers who are actively house-hunting think that the information available to them about house purchase is confusing – but 34 per cent think it is informative and 24 per cent say it is easy to find.

By the time they have actually gone on to purchase a property, however, views have changed. Among first-time buyers who have completed a purchase in the past year, 38 per cent describe the information available to them as informative and another 38 per cent say it was easy to find. Only 25 per cent say it was confusing.

Karl Hick said: “It may be that once they get fully involved in house purchase, first-time buyers discover that information is not as difficult to find and understand as they thought initially. Or it may be that more of those who thought available information was informative and easy to find actually went on to make a purchase!”

Other results of the survey show that the government’s Help to Buy scheme is particularly important for first-time buyers. Some first-time buyers told Larkfleet researchers that they would not have been able to purchase a home without it.

Larkfleet carried out the research with the support of First Time Buyer magazine to gain a better understanding of this important part of the company’s market.

Lynda Clark, editor of First Time Buyer magazine, said: “Getting onto the property ladder is such a different process for first-time buyers today compared with previous generations.

“The different challenges faced by todays’ buyers typically mean that a much larger deposit is required and so inevitably many potential buyers end up delaying the process. With many of the deposit reducing schemes available today, there are new means and ways to take that first step onto the ladder. The key is making sure that new buyers fully understand these schemes and see how they can help them as well as future generations to buy their first home.”

Karl Hick added: “Many of the homes we sell are bought by first-time buyers. The research has helped us to get a better understanding of their needs – not just what they want from our homes but also what they need in terms of information to help them make the right decisions about getting onto the property ladder.”